How Do Bitcoin Ordinals Work? A Simple Guide to Bitcoin NFT Revolution

Bitcoin Ordinals are a new and exciting development in the Bitcoin ecosystem that allows users to create non-fungible tokens (NFTs) directly on the Bitcoin blockchain.

Often referred to as “Bitcoin NFTs,” Ordinals are turning SATs (the smallest units of Bitcoin) into unique digital assets and collectibles.

In this comprehensive guide, we’ll explain exactly what Ordinals are, how they work from a technical perspective, their key differences compared to traditional NFTs, popular Bitcoin Ordinal projects, and how to inscribe, buy, sell Ordinal NFTs.

Table of Contents

What Are Bitcoin Ordinals?

Bitcoin Ordinals refers to a system that assigns each satoshi on the Bitcoin blockchain a unique ordinal number based on the order they are mined.

SATs are the smallest units of Bitcoin, with each satoshi equal to 0.00000001 BTC. There will eventually be a maximum supply of around 2.1 quadrillion sats once all 21 million bitcoins are minted.

By assigning an ordinal number to each SAT, the protocol allows them to be individually identified and tracked. This system was developed by Bitcoin developer Casey Rodarmor and is known as Ordinal Theory.

The key innovation of Bitcoin Ordinals is that each sat can also be “inscribed” with additional data, such as text, images, audio or video. This turns an otherwise fungible satoshi into a non-fungible token (NFT) that represents a unique digital artifact.

So in summary, Bitcoin Ordinals refer to both the sequential numbering of sats based on their order of creation and sats inscribed with unique metadata to create NFTs.

How Do Bitcoin Ordinals Work Technically?

On a technical level, Ordinals leverage two key upgrades that have expanded Bitcoin’s functionality – SegWit and Taproot.

SegWit Enables More Data Capacity

The SegWit upgrade in 2017 restructured how data is stored in Bitcoin blocks. It introduced the concept of a “witness” section that stores signature data separately from the transaction data.

This helped increase Bitcoin’s block size capacity without requiring a disruptive hard fork. The witness section freed up space to allow more transaction data to be stored on-chain.

Taproot Improves Scripting Capabilities

The Taproot upgrade activated in 2021 improved Bitcoin’s scripting capabilities and privacy. Most importantly for Ordinals, it introduced a new Taproot output type that can store arbitrary data efficiently.

Ordinal inscriptions are created by embedding metadata in a taproot script-path spend script, which is then revealed when the UTXO is spent. This provides a standardized way to embed and reveal data on Bitcoin.

Minting an Ordinal NFT

To mint an Ordinal NFT, a user first creates a Taproot output containing the inscription data and an “envelope” that hides the content. This output locks the sat(s) and inscription data.

When the user wishes to reveal the inscription, they spend the output in a transaction that exposes the metadata publicly on Bitcoin. The inscription is now immutable and the inscribed sat can be tracked deterministically as an NFT.

So in summary, the Ordinals protocol provides Bitcoin with a mechanism for embedding, tracking, and revealing arbitrary data pegged to specific sats. This turns sats into NFTs with on-chain metadata.

How Are Ordinals Different From Traditional NFTs?

While Ordinal inscriptions allow sats to function like NFTs, there are some key differences compared to Ethereum-based NFTs and standards like ERC-721.

1. They’re Inscribed, not Tokenized

Ordinal NFTs aren’t separate tokens like ERC-721 NFTs on Ethereum. They simply embed metadata directly into sats, which remain fungible at the base protocol layer.

2. Ordinals Are Stored On-Chain

Metadata for Ethereum NFTs is often stored off-chain, just referenced by a token ID. Ordinal data is directly written into Bitcoin transactions, ensuring maximum immutability.

3. BTC Ordinals have Block Size Limit

Bitcoin’s block size limit caps the amount of Ordinal NFT data per block, unlike Ethereum’s unlimited data capacity. This restricts Bitcoin NFT minting.

4. No Smart Contracts

Smart contracts power most NFT functions and markets on Ethereum. Ordinals have no native smart contract support, limiting functionality and usability.

5. There’s no Content Moderation

Illegal or inappropriate metadata embedded into Bitcoin via Ordinals is uncensorable, unlike centralized NFT platforms.

So in summary, while Ordinals enable NFT-like functionality on Bitcoin, there are limitations compared to ethereum NFTs or those on other smart contract blockchains. The trade-offs center around immutability vs functionality.

Popular Bitcoin Ordinal NFT Projects

Despite the technical challenges, many exciting NFT collections have already been created using the Bitcoin Ordinals protocol. Here are some of the most popular projects so far:

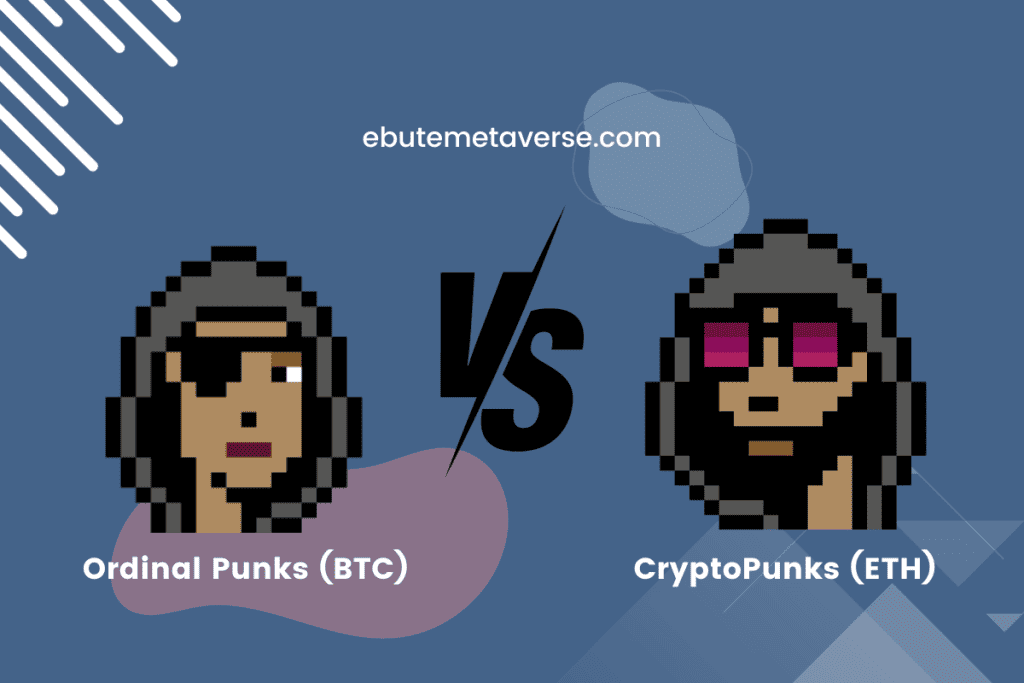

Ordinal Punks

Inspired by the famous CryptoPunks on Ethereum, Ordinal Punks generated 100 unique pixel art NFTs inscribed onto the blockchain. They were minted in the first 650 inscription transactions.

Taproot Wizards

Taproot Wizards is an early hand-drawn NFT collection created by Udi Wertheimer. The art depicts wizards casting magical spells, linking it thematically to Bitcoin’s Taproot upgrade.

Bitcoin Rocks

Paying homage to one of the earliest NFT projects, Ether Rocks, Bitcoin Rocks is a set of 100 collectible rock NFTs. Their inscriptions are spread throughout the early Ordinals.

Timechain Collectibles

This exclusive collection depicts 21 intricately designed timepieces as Ordinal NFTs. Ranging from ancient sundials to futuristic wristwatches, they showcase the broad creative potential.

Ordinal Loops

Mathematical animations called Ordinal Loops were among the first Ordinals minted. Their inscriptions are exceptionally early, starting from sequence #452.

These projects reveal the enthusiasm around extending Bitcoin’s functionality into digital art and collectibles via NFTs. More new and innovative collections will undoubtedly emerge as the technology matures.

How Do You Buy and Sell Bitcoin Ordinals?

When Bitcoin Ordinals first came out, they were predominantly traded over-the-counter (OTC). This is a type of decentralized, person-to-person exchange.

This method of trading typically involved:

- Discovery: Buyers and sellers would find each other in online forums, social media platforms, or dedicated Discord channels.

- Negotiation: Parties would discuss prices and terms privately, often without a standardized market value to guide them.

- Verification: Both parties needed to trust each other or rely on reputation, as there was no official system to verify the Ordinals or the transaction.

- Escrow: To mitigate the risk of fraud, transactions often required the use of an escrow service to hold the Bitcoin until the Ordinal was confirmed transferred.

Thankfully, we now have dedicated marketplaces that simplify the process and reduces risks.

Top Ordinals Marketplaces

Some of the marketplaces where you can trade Bitcoin Ordinals include:

- Magic Eden: Expanding from other blockchains to include BTC Ordinals.

- Gamma: Offering a full suite of services for artists and NFT designers, including royalties from secondary sales.

- Ordinals.market: A professional trading platform with detailed market analytics.

- OrdinalHub: An aggregator providing data from various Ordinals marketplaces.

- Ordswap: A user-friendly platform for buying, trading, and generating Ordinals.

- Ordmarket: A trustless marketplace and wallet built on the Bitcoin blockchain.

Trading Ordinals on Marketplaces

To trade Ordinals on these marketplaces, generally, you would:

- Set Up a Compatible Wallet: Ensure you have a wallet that supports Bitcoin Ordinals, such as Sparrow for receiving or Ord for inscribing and managing.

- Choose a Marketplace: Select one of the dedicated marketplaces that best suits your needs.

- Create or Log In to Your Account: Sign up if you are a new user or log in to your existing account on the marketplace.

- Deposit Funds: Transfer Bitcoin to your marketplace wallet to prepare for purchasing Ordinals.

- Browse Collections: Look through the available Ordinals and select the one you wish to purchase or place your own Ordinal for sale.

- Transaction: Follow the marketplace’s process to buy or sell the Ordinal. This could involve bidding, buy now options, or setting up an auction.

- Confirmation: Wait for the transaction to be confirmed on the blockchain, which finalizes the purchase or sale.

How To Inscribe Your Own Bitcoin Ordinal

Inscribing your own Bitcoin Ordinal is straightforward with the right tools:

- Download a compatible Bitcoin wallet like Xverse, Hiro, or UniSats that provides a Taproot address starting with “bc1p”. This is required for Ordinal support.

- Go to an inscription service like Gamma, OrdinalsBot, or Unisats. These platforms make it easy to upload your content and handle the inscription process.

- Upload your image, video, or other content. Maximum size is 400KB without miner assistance. The service will optimize your file automatically.

- Enter the “bc1p” Bitcoin address from your wallet where you want the inscribed satoshis sent after minting.

- Pay the Bitcoin network fee for the transaction and wait approximately 10 minutes for your inscription to be mined and sent to your wallet address.

Once the inscription transaction appears in your wallet, you’ve successfully created your own Bitcoin Ordinal! You can now hold it, sell it, or list it for sale on marketplaces like Gamma, Magic Eden, or Ordswap.

The process is straightforward with the right tools. So don’t be intimidated to give minting your own Bitcoin NFT a try using these user-friendly inscription services.

What Do Bitcoiners Think About Ordinals?

The rise of Bitcoin Ordinals has been controversial within the Bitcoin community. Here is a summary of some of the key perspectives:

Pros

- Expands Bitcoin’s utility beyond just payments

- Helps secure the network by generating more fees

- Allows greater creativity and free expression on Bitcoin

- Makes Bitcoin more competitive with other blockchain NFT platforms

Middle ground

- Neutral about Ordinals specifically, but believe developers should build on higher layers rather than protocol changes

- No issue expanding use cases, but believe it’s very early and unproven if it enhances BTC’s value

Cons

- Contradicts Bitcoin’s ethos and vision as purely a payment system

- Damages fungibility by distinguishing specific coin histories

- Bloats the blockchain with non-financial data

- Enables content that may be illegal or harmful

- Distracts from Bitcoin’s core value proposition

The debate around Ordinals essentially boils down to disagreements on Bitcoin’s purpose and the importance of absolute fungibility. But overall, it represents a thought-provoking development in line with Satoshi’s original vision of an extensible blockchain.

What is the BRC-20 Token Standard?

In addition to NFTs, the Ordinals protocol has enabled the creation of the BRC-20 token standard for fungible tokens on Bitcoin.

Inspired by ERC-20 on Ethereum, BRC-20 tokens use Ordinal inscriptions to define and manage token supplies and transfers. However, unlike ERC-20, BRC-20 does not actually employ smart contracts since they are not possible on Bitcoin.

Instead, BRC-20 tokens store token metadata and logic rules as JSON data embedded directly into satoshis using the Ordinals system. Wallets and applications can interpret this standardized JSON to implement fungible token functionality.

Over 34,000 BRC-20 tokens have already been created, demonstrating inventive ways to expand Bitcoin’s capabilities via Ordinals. However, the lack of smart contracts and enforcement of BRC-20 rules on-chain raises questions about their reliability and security.

What Are the Effects on the Bitcoin Network?

The sudden popularity of Bitcoin Ordinals has significantly impacted blockchain activity and the network:

- Increasing fees: Ordinal mints now make up a large portion of transaction fees, generating millions for miners.

- More data: inscriptions have caused the average block size to increase by 1-2 MB.

- Validator burden: the extra data places storage and processing demands on node operators.

- Threats to fungibility: distinguishing “special” bitcoins via NFTs reduces fungibility.

- Uncensorable content – inappropriate Ordinal inscriptions are permanently embedded into Bitcoin’s blockchain history.

While many believe these effects are manageable short-term, they spark debates about Bitcoin’s long-term direction and philosophy. The impacts may increase if Ordinals see continued rapid adoption.

Frequently Asked Questions About Bitcoin Ordinals

What are the risks of Bitcoin Ordinals?

Possible risks include…

- Decreased network capacity for payments

- Validators forced to store more data

- Accidentally losing inscribed NFT satoshis when spent

- Permanently embedding inappropriate/illegal content

- Damaging Bitcoin’s fungibility as a currency

- Distracting from Bitcoin’s core value as decentralized money

However, many argue these risks are manageable and that expanded use cases improve Bitcoin’s security.

How much are Bitcoin Ordinals worth?

Prices for top Bitcoin Ordinals currently range from around 0.5 BTC to over 50 BTC. But most are valued based on their artwork and collection, not the underlying sats.

An ordinary non-inscribed satoshi has an extremely low USD value (~$0.00023). But an inscribed sat gains value from its digital scarcity as an NFT, similar to crypto art NFTs.

How do I invest in Bitcoin Ordinals?

First, you’ll need a compatible wallet like Sparrow or a full node with custom software. Then browse Ordinal collections and join associated Discord/Telegram groups to find buying opportunities.

Purchases are done via direct messaging or escrow services. Be very careful to verify legitimacy and custody to avoid scams.

Are Ordinals good or bad for Bitcoin?

There are reasonable arguments on both sides:

Good

- Expands use cases builds a broader developer ecosystem

- Additional network fees improve security incentives

- Allows free expression and creativity with Bitcoin

Bad

- Contradicts Bitcoin’s role as purely a payment system

- Damages fungibility by tracking specific coins

- Bloats blockchain data with non-financial info

- Distracts from core value proposition as “digital gold” money

Conclusion

The recent innovation of Bitcoin Ordinals presents a fascinating new way to create provably scarce digital assets and NFT collectibles directly on top of Bitcoin. By inscribing metadata onto individually numbered satoshis, the Ordinals protocol leverages Bitcoin’s security, permanence, and expanding scripting capabilities.

But Ordinals also represent a profound philosophical shift in distinguishing specific coins and expanding Bitcoin’s role beyond just a payment network. This is causing heated debate within the Bitcoin community on the importance of absolute fungibility versus enabling broader use cases.

Regardless of your perspective on these issues, Bitcoin Ordinals showcase the creative spirit around building a decentralized digital economy on top of Bitcoin. The coming years will determine if Ordinals are a passing fad or a genuinely useful expansion of Bitcoin’s utility in the Web3 era.