Understanding Crypto Futures Grid Bot for Beginners

Many crypto traders are now using cryptocurrency futures grid trading bots to make passive income by automating their trading strategies. Grid bots allow you to buy low and sell high within a preset price range on futures contracts.

In this beginner’s guide, we will cover everything you need to know about crypto futures grid bots, including:

What are Crypto Futures Grid Bots?

Crypto futures grid bots are preconfigured trading bots offered by various platforms and exchanges. They allow you to automate a trading strategy known as grid trading on crypto futures contracts.

Grid trading involves placing buy and sell orders at predefined intervals to take advantage of volatility in the market. The bot automatically places these orders around the current market price based on the parameters you set.

As the market moves up and down, the bot will execute buy and sell orders according to the grid strategy, helping you profit during volatility. Crypto futures grid bots take the manual work out of grid trading and automate the process for you 24/7.

Is Grid trading bot profitable?

Grid trading bots are quite profitable as they help traders looking to make the most of their money without spending all their time on trading. By handling the buy and sell part automatically, grid bots help free up time for traders to dive into market trends or other research. It also allows you to earn passive income on the side without having to keep a constant eye on the market.

How Do Crypto Futures Grid Bots Work?

Crypto futures grid bots use a grid trading strategy to place buy and sell orders at regular price intervals above and below the current market price. Here are the steps involved:

- You select a cryptocurrency futures market you want to trade, like Bitcoin or Ethereum.

- Manually configure the settings or use a preconfigured AI futures bot.

- The bot places staggered buy and sell orders above and below the market price based on the defined settings.

- When the market price moves up, sell orders get triggered, locking in profits.

- When the market price drops, buy orders are executed to accumulate positions.

- The process repeats continuously with the bot closing orders and opening new ones.

- You can halt trading and settle your position anytime you want.

The grid trading strategy allows you to build a position over time by buying at lower prices and selling at higher prices. The more the market volatility, the more your orders get executed, leading to potential profits.

Advantages of Crypto Futures Grid Bots

There are several key benefits that make crypto futures grid bots an appealing option for beginners:

Require less monitoring

Grid bots are set up to execute trades automatically based on preset conditions, freeing you up from watching the markets constantly.

Compound gains

By selling high and buying low, grid bots are able to accumulate small gains that compound into noticeable profits over time.

Effective for volatile assets

Grid trading thrives with assets that experience frequent price swings within a range, ideal for volatile crypto futures.

Stop losses minimize downside

Stop loss orders placed above and below the grid limit losses on trades going the wrong way.

Diversify trading strategies

Grid bots can add algorithmic trading to complement other manual or automated strategies for crypto futures.

Available 24/7

Grid bots run continuously and are not restricted by trading hours, maximizing trading opportunities.

How to Set Up a Crypto Futures Grid Bot

Many cryptocurrency exchanges like Binance, Coinbase, and Bybit offer preconfigured grid trading bots for crypto futures markets. These make setting up a grid bot very easy for beginners.

Here’s how to set up your first futures grid bot:

- Select the exchange you want to trade on, like Binance or Bybit.

- Browse the selection of prebuilt grid bots offered for different crypto futures pairs.

- Pick a futures market, like BTC/USDT or ETH/USDT, that you want to trade.

- Choose one of the ready-made grid bot strategies and customize it.

- Adjust settings like the price range, order quantity, and profit targets.

- Turn on the bot, and it will start placing buy and sell orders automatically based on the grid strategy.

- The exchange will execute these orders 24/7 based on market movements.

You can monitor the performance and pause or stop the bot anytime.

This preconfigured approach makes running a futures grid bot very simple for beginners. You don’t need coding skills or API access. The exchange handles order execution per the bot strategy you select.

What are the best Futures Grid bots?

Here are some of the top crypto futures grid bots to consider for beginners:

- Binance Grid Trading Bot: Offered on Binance Futures, this grid bot has preconfigured strategies for BTC, ETH, ADA, and DOT markets. It is easy to set up for beginners and includes useful risk management features.

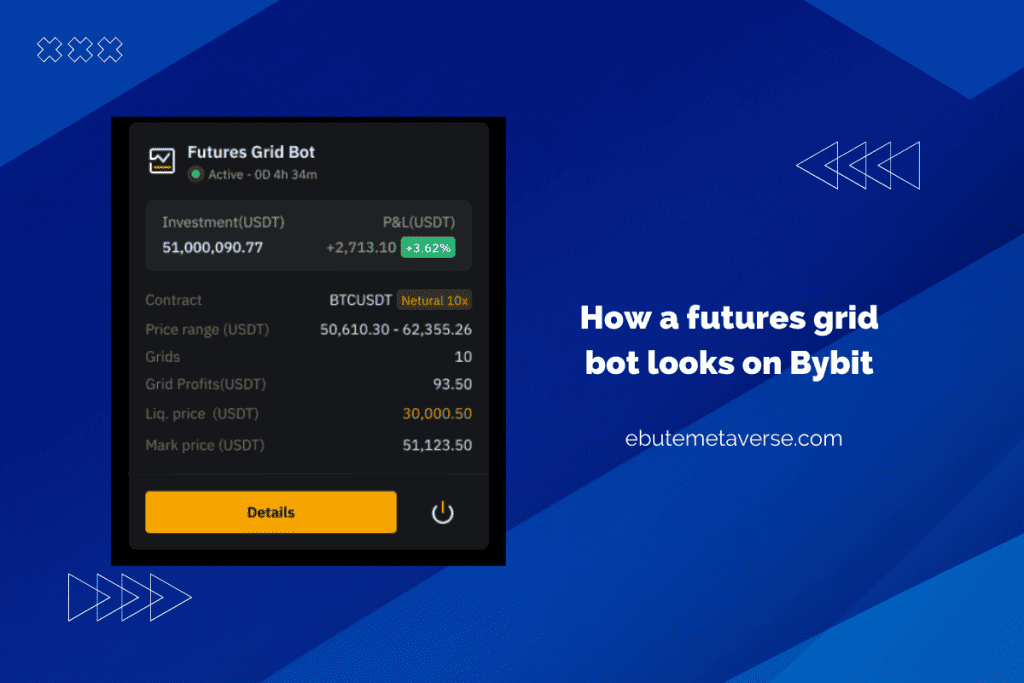

- Bybit Grid Bot: Bybit provides a grid bot for its futures and spot trading markets. You can copy preconfigured grid bots for free or create your own from scratch.

- Pionex Grid Bots: Pionex specialises in trading bots and offers 12 different grid bot strategies for futures and spot trading. Easy to use with 100x leveraged trading supported.

- Bitsgap Futures Grid Bots: These bots provided by Bitsgap offer templated grid trading strategies across 10 major exchanges. Good for multi-exchange bot trading.

- KuCoin Futures Grid Trading Bot: Grid trading bots are available for BTC and ETH futures on KuCoin with easy setup and bot control options.

- 3Commas Grid Bots: Compatible with 20 exchanges, 3Commas grid bots allow automated futures trading with dollar cost averaging.

These are solid preconfigured grid trading bots suitable for beginners. Key factors to consider are the reliability of the platform, supported markets, ease of use, features, and security. Review multiple options before deciding on the best crypto futures grid bot for your needs.

How risky are trading bots?

Crypto futures grid bots do carry some risks that beginners should be aware of:

- Technical risks: Bots are prone to technical errors or connectivity issues that could cause losses. Monitoring their operation is important.

- Volatile markets: Very volatile market swings can lead to multiple orders being triggered beyond anticipated levels, resulting in larger losses.

- Exchange risks: If the exchange experiences issues like liquidations, grid bots can face significant losses.

- Parameter risks: Poorly chosen bot parameters like range size or order quantities can optimize performance. Conservative settings are best initially.

- Loss risks: inadequate stop losses or not accounting for trading fees could make losses exceed profit targets.

Tips to Reduce the Risk of Trading with Grid Bots

While grid bots have their own risks, there are ways to mitigate them:

- Start with small position sizes: This will limit any potential losses as you evaluate bot performance.

- Use tight, conservative ranges: Wider price ranges increase the risk of overexposed positions during big market swings.

- Implement stop losses: Stop losses on each order or overall position can restrict the downside.

- Frequently monitor bot operation: Check in routinely to ensure the bot runs smoothly.

- Backtest strategies: Backtesting on historical data helps choose effective parameters.

- Diversify across markets: running bots across multiple futures pairs spreads risk.

Conclusion

Crypto futures grid bots offer an appealing option for traders looking to automate market-making strategies and compound gains over time. By consistently buying low and selling high within a defined price channel, grid bots are especially suitable for volatile crypto assets.

As with any trading system, it’s important to exercise risk management using stop losses. Start with small position sizes and conservatively wide grids to tune the bot for optimal performance.